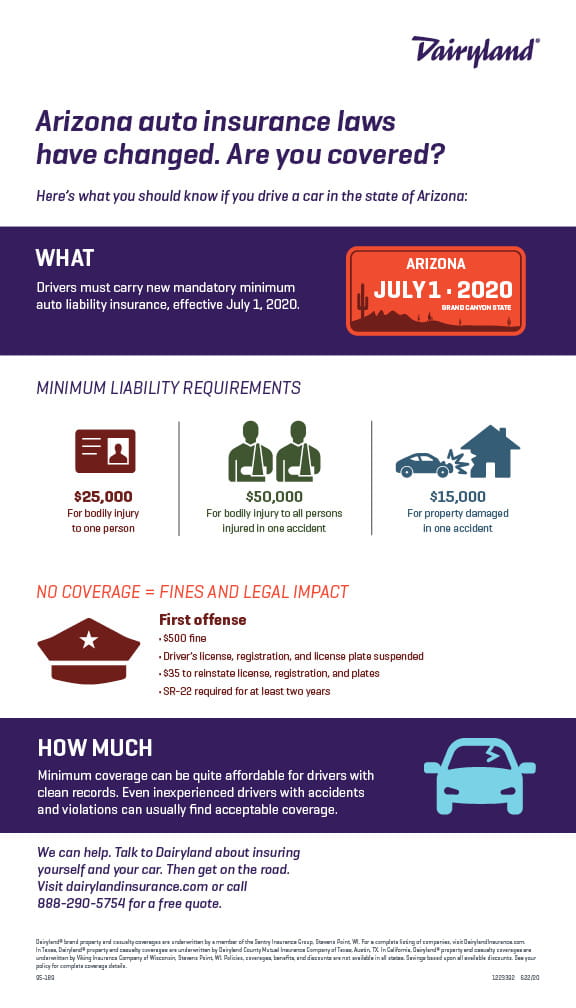

If you currently hold an auto insurance policy in Arizona, changes are headed your way. Beginning July 1, Arizona’s minimum limit for auto insurance liability will increase from $15,000/$30,000/$10,000 to $25,000/$50,000/$15,000, due to Arizona SB 1087.

Breaking down the minimum insurance coverage limits

Minimum limit requirements contain three numbers. In Arizona’s case, the first two numbers, $25,000/$50,000, refer to bodily injury coverage and represent how much your insurance provider will pay for medical expenses of individuals injured, legal fees, loss of income, and possibly more for an accident you cause. The first number ($25,000) represents the maximum amount your insurance company will pay out for each individual injured in the accident. The second number ($50,000) represents the maximum amount your insurance will pay out for people injured in the accident, regardless of how many individuals are injured.

The third number, $15,000, known as property damage liability, represents the maximum amount your insurance provider will pay for property damage you cause to another person’s property in an accident.

What this means for you if you hold an Arizona auto insurance policy

As a result of this minimum policy limit increase, you’ll have a higher level of coverage on the road. So, if you get into an accident, you and the other driver will both have more protection.

If you currently carry the minimum required insurance in Arizona, expect to see an automatic change to your policy after its renewal following July 1. This could also mean that you’ll see a payment increase as a result of the higher level of coverage required.

What this means for you if you’re going to purchase an Arizona car insurance policy

If you purchase a new policy on or after July 1, you’ll be required to purchase at least $25,000/$50,000/$15,000 coverage to adhere to the new limit.

What to do if you have more questions about Arizona’s minimum insurance coverage

Regardless of your city, state, or coverage levels, you can count on Dairyland® to be there for you through changes like these and any others that may come your way. If you have questions, reach out to your Dairyland insurance agent.

Related links:

Worried about how this will impact your rates? Be sure to check in with your Dairyland agent, and check out these discounts Dairyland offers.

Looking for ways to save on car insurance? Take a look at this post about lowering your insurance rates.

Dairyland® is affordable insurance that works for you.

No matter what journey you’re on, we’re all driving down the same road. And we’re here to help protect you when you need us most. For decades, customers like you have trusted Dairyland® for:

- Car insurance

- Motorcycle insurance

We offer customized coverage, money-saving discounts, flexible payment options, SR22s, and outstanding customer service.

Contact Morgan Insurance & Financial Services today to experience the Dairyland® difference for yourself.